GOLD RATE IN DELHI

10g of 24K gold in Indian Rupee

74,490

10g of 22K gold in Indian Rupee

68,233

Today Gold Rate

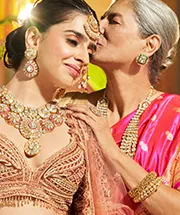

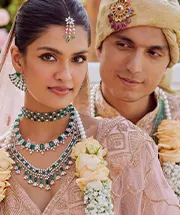

Gold holds a special place in the hearts and culture of India, being not just a precious metal but a symbol of wealth and prosperity. Keeping up with the demand for gold in the country, RK Jewellers presents the latest updates on today’s gold rate in India. we delve into the intricate world of gold rates in India, with a particular focus on today’s rates as presented by the esteemed RK Jewellers.

Our team of experts closely monitors the fluctuations in the gold market to bring you the most accurate and up-to-date information on gold prices in India. Whether you are an avid investor or simply looking to purchase some gold jewellery, our daily updates on gold rates will help you make informed decisions.

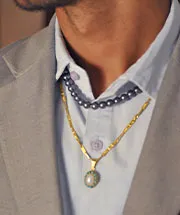

At RK Jewellers, we understand the importance of gold in our customers’ lives. That’s why we offer a wide range of gold jewellery designs, from traditional to contemporary, to suit every taste and occasion. Our commitment to quality and craftsmanship has earned us the trust and loyalty of our customers over the years.

Stay tuned to our website for the latest updates on today’s gold rate in India and explore our exquisite collection of gold jewellery to add to your collection.

| Metal Quality | Yesterday Rate Per 10 Gram | Today Rate Per 10 Gram | Price Change |

| 24 Carat Gold | Rs. | Rs. | Rs. |

| 22 Carat Gold | Rs. | Rs. | Rs. |

| 18 Carat Gold | Rs. | Rs. | Rs. |

| 14 Carat Gold | Rs. | Rs. | Rs. |

Gold Historical Prices Chart

How to calculate Today’s Gold Rate in India

The determination of gold rates in India relies on various factors. One of the significant factors is the international market. The prices of gold in the international market determine the gold rates in India. Moreover, the fluctuation of the Indian rupee against the US dollar significantly influences the pricing of gold in India. Other factors that impact gold prices include government taxes and duties, import charges, and local demand and supply. The prices of gold are updated regularly on various platforms, including news channels, websites, and mobile applications, allowing consumers to stay updated on the current gold rates in India.

Some factor of calculate gold rate:

1. Historical Perspective

The journey of gold rates in India has witnessed significant transformations over the years. From traditional barter systems to sophisticated electronic trading, understanding the historical context provides a foundation for grasping the contemporary mechanisms at play.

Market Forces and Global Impact

The interconnectedness of global markets has a profound impact on gold rates in India. Fluctuations in international markets, influenced by economic indicators and geopolitical events, reverberate in the local pricing of gold.

2. Government Regulations

Government policies and regulatory bodies play a pivotal role in shaping the landscape of gold rates. Understanding the regulatory framework provides insights into the stability and reliability of gold as an investment.

3. Demand and Supply Dynamics

The age-old economic principle of demand and supply is a key determinant of gold rates. Examining the seasonal variations and emerging trends in gold demand sheds light on the pricing dynamics.

4. Role of Banks and Financial Institutions

The financial sector, particularly banks, has a symbiotic relationship with gold rates. Gold loans and financial policies impact the pricing structure, reflecting the broader economic landscape.

5. Digitalization and Technological Advancements

In the era of digitalization, technology has become a driving force in determining gold rates. Online platforms and technological advancements have reshaped the accessibility and transparency of gold pricing.

6. Cultural and Festive Influences

Cultural events and festivals significantly influence gold rates. Understanding the impact of traditions and celebrations on gold demand provides a nuanced perspective on pricing fluctuations.

7. Inflation and Economic Stability

Throughout history, gold has been viewed as a safeguard against the effects of inflation and economic turbulence. Analyzing the correlation between inflation rates and gold prices offers insights into its role as a safe haven.

8. Mining and Production Factors

Domestic gold production and global mining trends contribute to the overall supply of gold, impacting its pricing. Exploring these factors provides a comprehensive understanding of the market forces at play.

9. Jewelry Industry Trends

The ever-evolving trends in the jewelry industry have a direct impact on gold pricing. Design preferences and fashion trends influence the demand for gold, subsequently affecting its rates.

10. Speculation and Investment Trends

Speculation plays a significant role in gold pricing. Understanding the patterns of speculation and investment in the gold market provides a holistic view of the pricing dynamics.

11. Impact of Geopolitical Events

Global markets are significantly influenced by geopolitical events, with gold being just as susceptible to their impact. Examining historical instances of geopolitical events influencing gold rates offers valuable insights.

12. Forecasting Gold Rates

Predicting gold prices is both an art and a science. Various techniques, coupled with expert opinions and market analysis, contribute to forecasting gold rates. Understanding these methodologies enhances our ability to anticipate future trends.

The determination of gold rates in India is a complex interplay of historical legacies, market forces, government regulations, and socio-cultural influences. As we navigate through the intricate web of factors, it becomes evident that gold rates are not merely numerical values but a reflection of the dynamic economic and cultural landscape.